Cloud accounting advantages extend far beyond convenience. For executives managing growth, regulatory pressure, and margin expectations, real-time financial data is a strategic asset that strengthens decision-making, improves compliance, and increases operational agility.

Many organizations adopt cloud systems to modernize bookkeeping. The real value appears when reporting becomes continuous rather than periodic. If you are exploring implementation considerations, our article on cloud-based accounting software to streamline operations outlines how these systems improve efficiency and visibility.

Why Cloud Accounting Advantages Matter for Strategic Agility

Traditional reporting cycles delay insight. By the time month-end reports are finalized, opportunities to respond may already be gone. One of the core cloud accounting advantages is immediate access to current financial data, allowing leaders to evaluate performance in real time.

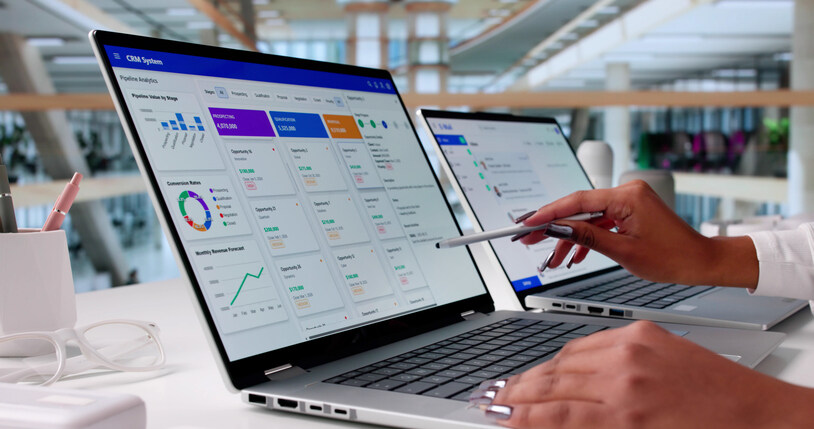

Real-time dashboards provide visibility into cash flow, receivables, payables, and margin trends. This clarity enables faster adjustments to pricing, staffing, inventory, or capital allocation. When financial insight is current, strategy becomes proactive rather than reactive.

For businesses in oil and gas, manufacturing, and industrial services, this responsiveness directly impacts profitability. Cost volatility and regulatory change require accurate data to support confident decisions.

Strengthening Compliance and Financial Control

Cloud accounting advantages also improve regulatory compliance and oversight. Modern platforms maintain audit trails, time-stamped transaction histories, and automated documentation. This enhances transparency during CRA reviews and external audits.

Ongoing reconciliation keeps accounts accurate throughout the year, strengthening audit readiness and supporting the discipline outlined in our guide to best practices for end-of-year financial reporting.

Security is often a concern when evaluating cloud systems. In practice, reputable platforms use advanced encryption, multi-factor authentication, and secure data centers that frequently exceed the protection levels of local servers. When paired with a defined risk management strategy, cloud systems reduce financial exposure and improve executive oversight.

Technology alone does not ensure compliance. Governance, documentation discipline, and professional oversight remain essential.

Turning Financial Data Into Competitive Insight

Access to data alone is not the advantage. The advantage comes from using it effectively. Cloud accounting advantages support more sophisticated forecasting, scenario modeling, and performance analysis.

With accurate real-time information, leadership teams can:

- Monitor cash flow trends weekly instead of monthly

- Identify margin compression early and adjust pricing strategies

- Model capital investments before committing resources

- Evaluate compensation structures in line with tax planning objectives

- Respond quickly to covenant requirements from lenders

This insight supports informed decision-making at every stage of growth. Instead of relying on historical summaries, executives gain a forward-looking perspective grounded in reliable data.

When integrated with structured advisory support such as our corporate accounting services, cloud systems move beyond reporting and become part of a comprehensive financial strategy. Technology provides the data. Experienced advisors help interpret it and align it with long-term objectives.

Building a More Resilient Financial Framework

Adopting cloud systems is not simply a technology upgrade. It is a structural improvement to how financial information supports the business. When reporting, compliance, and forecasting are integrated within one platform, the finance function becomes a strategic partner rather than an administrative necessity.

Cloud accounting advantages create alignment between operations and finance. They reduce manual processes, improve reporting accuracy, and strengthen confidence during audits and regulatory reviews. Most importantly, they provide leaders with clarity when timing and precision matter most.

For businesses seeking stronger financial visibility and greater strategic control, implementing the right cloud framework can be a defining step. Partnering with Cook & Company ensures that your cloud accounting systems are implemented thoughtfully, aligned with your growth goals, and positioned to deliver long-term clarity and confidence. Contact our team at Cook & Company to discuss how the right cloud accounting framework can support your growth with clarity and confidence.