Information moves faster than ever, and so must your financial data. For many Canadian businesses, the shift from traditional desktop accounting systems to cloud-based platforms has become a turning point for efficiency, accuracy, and insight. Cloud accounting isn’t just about convenience; it’s about creating real-time financial visibility that allows leaders to make confident, informed decisions.

The Shift Toward Smarter Financial Management

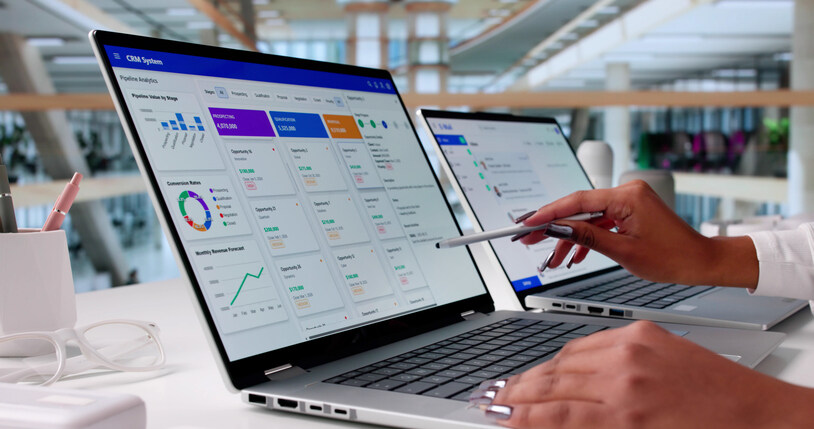

Gone are the days when accounting meant waiting for monthly reports or searching through paper files. Cloud-based accounting software allows businesses to access up-to-date financial data anytime, anywhere. This shift eliminates bottlenecks that once slowed decision-making and ensures that your leadership team always has a clear view of performance. When transactions are updated automatically and stored securely, you can spot trends earlier, correct course faster, and maintain tighter control over cash flow.

Accuracy and Efficiency in Real Time

One of the most powerful advantages of cloud accounting is automation. Manual data entry, long a source of human error, is replaced by automated bank feeds, integrated payroll systems, and synchronized invoicing. These features don’t just save time; they strengthen accuracy. Fewer errors mean fewer costly corrections, and that accuracy extends beyond bookkeeping into forecasting and tax compliance. When your numbers are clean, your strategic planning is sharper and your audit risk decreases.

For more ways to build efficiency into your accounting framework, explore our article How to Optimize Your Accounting Processes for Growth, which outlines strategies for scaling financial systems that evolve with your business.

Strengthening Security and Compliance

Security remains a top concern for executives considering any cloud solution. The reality is that modern cloud accounting platforms are built with advanced encryption, multi-factor authentication, and secure data centers that often exceed the protection levels of traditional in-house systems. Regular updates ensure compliance with current security standards, while access controls allow you to decide who sees what. Rather than storing sensitive financial data on local devices that could be lost or compromised, the cloud centralizes your information safely and efficiently.

Collaboration Without Barriers

In today’s hybrid work environment, flexibility is no longer optional. Cloud accounting gives your team and advisors the ability to collaborate in real time, whether they’re in the same office or across the country. Your CPA can review transactions, provide feedback, and make adjustments without waiting for end-of-month reports. This seamless connection allows for faster insights and better strategic alignment between your internal team and your professional partners. When collaboration happens continuously, not periodically, the quality of financial management improves dramatically.

Reducing Costs and Increasing Value

While moving to a cloud system may seem like a major transition, it often reduces costs over time. Subscription-based pricing replaces large upfront software purchases, and automatic updates mean you’re always using the latest version, no maintenance or IT intervention required. Moreover, automation reduces the need for manual oversight, freeing your finance team to focus on analysis and strategy rather than data entry. The result is not just cost savings but a higher return on your financial operations overall.

Building a Future-Ready Business

Cloud-based accounting is more than a technological upgrade, it’s an operational evolution. By uniting automation, collaboration, and security, it gives business leaders the tools to stay agile and informed in an increasingly digital economy. When financial data flows seamlessly and accurately, your company can respond faster to challenges and opportunities alike.

At Cook & Company, we help executives and owners integrate cloud-based accounting systems that enhance visibility, reduce inefficiencies, and strengthen decision-making. The future of business finance is real-time, transparent, and connected, and with the right tools in place, you can get there today.